workers comp taxes for employers

Contributions are payable for all employees who are between ages fourteen 14 years to sixty-five 65 for each contribution. The quick answer is that generally workers compensation benefits are not taxable.

Workers Compensation Claims Involving Remote Workers What Employers And Hr Professionals Need To Know Lewis Brisbois Bisgaard Smith Llp

The long and short of it is no.

. Grow Your Business Save a Life - One of the best recovery tools for addiction is a job. Effective Tax Rate. Its the insurance company that.

Your Effective Tax Rate for 2022 General Tax Rate GTR Replenishment Tax Rate RTR Obligation Assessment Rate OA Deficit Tax Rate DTR. It doesnt matter if theyre receiving benefits for a slip and fall accident muscle strain back injury. Furthermore your pre-tax wage or salary is the base number for which your benefits.

Here we go. Business owners are able to deduct the costs of required. Yes workers comp is taxable.

These deductions can include things like health insurance or specific retirement plans. In Texas coverage is voluntary for most. A Social Security contribution week is from Monday to Sunday.

Employers contribute 230 multiplied by the number of covered employees working on the last working day of the. Workers comp is not deducted from payroll taxes. How Does Workers Comp Affect a Tax Return.

If they also receive 2000 per month in workers comp payments total benefits would amount to 4200 which is 105 of the employees average current earnings. The answer is simple. Since having workers comp.

An Employer is any person business or organization who employs a person s including spouse ages fourteen 14 years or older to work eight hours or more in a week. Persons earning between 2600001 and 27000 personal relief is 24600. FICA Taxes Unemployment Insurance Workers Comp for Owners.

The Employee Income Tax is a tax that must be filled by all persons receiving an income. The employer is 100 percent responsible for paying premiums to an insurance company. The fee is similar to a tax and is 430 per employee per calendar quarter.

As an employer you would not pay employee taxes on a 1099 subcontractor because they are not an employee. In the vast majority of cases you dont have to pay taxes on. Employment Taxes - Arizona Withholding Tax.

Yes workers comp payments and benefits that employers pay to their employees are deductible business expenses. The Social Security tax rate is 62 percent of an employees income. 6 hours ago For employers the two FICA tax rates are.

With agents from coast to coast EMPLOYERS provides targeted workers compensation insurance solutions for independent. Any workers comp payments and benefits that employers pay to their workers is a deductible business expense. From industry-specific safety training to individualized safety and health consulting services.

If you are the 1099 subcontractor. The amount paid should equal 80 of an employees after-tax average weekly wage including overtime and. Injured workers do not pay any tax on their workers compensation benefits.

Certain pre-tax deductions can be taken out of your employees payroll throughout the year. Workers compensation laws vary by state but all except for Texas require employers with over a certain number of employees to have this insurance. Just like its good practice to protect your employees and your business with workers compensation insurance.

Workers comp covers medical treatment lost wages and more while you recover or adjust to long-term disability. You dont have to pay taxes on weekly checks under workers comp. Workers Compensation Insurance from EMPLOYERS.

All wages salaries bonuses or other compensation paid for services performed in Arizona are subject to state income tax.

Tax Savings With Employee Benefits Paychex

How To Delegate Payroll Employee Related Tax Filings And Associated Employer Duties To A Professional Employer Organization The Cpa Journal

Do I Have To Pay Taxes On A Workers Comp Payout Bachus Schanker

Workers Compensation And Taxes Phalenlawfirm Com Ks And Molaw Office Of Will Phalen

What If I M A Payroll First Timer Insightfulaccountant Com

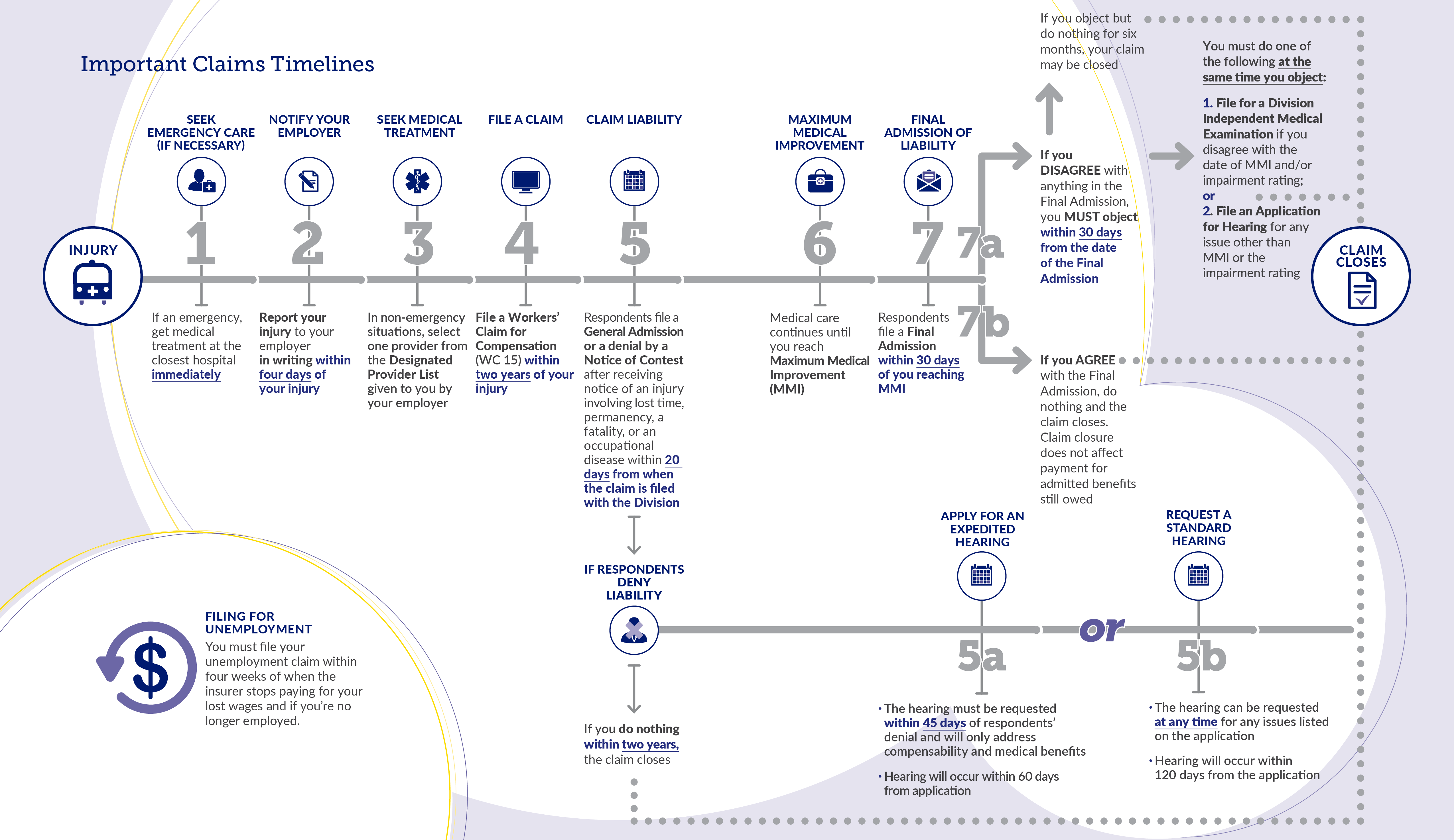

Workers Compensation Department Of Labor Employment

New Employer Ui And Construction Employer Tax Rates For 2022 State Of Delaware News

Is Workers Comp Taxable What To Know For 2022

Workers Compensation And Taxes James Scott Farrin

Alabama Income Tax Withholding Changes Effective Sept 1

Is Workers Comp Taxable Hourly Inc

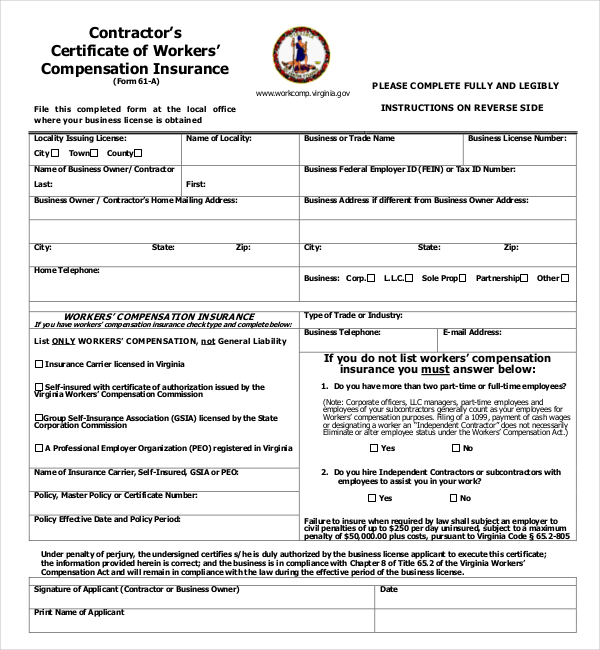

Free 13 Sample Workers Compensation Forms In Pdf Xls Word

Louisiana Workers Compensation Insurance Forbes Advisor

Is Workers Comp Taxable Workers Comp Taxes

Payroll Taxes 101 What Employers Need To Know Workest

Payroll Tax Calculator For Employers Gusto

Taxes And Workers Compensation For A 1099 Employee Trusted Choice

What Happens If My Employer Has No Workers Comp Insurance Ankin Law